Crypto virtual card sweden

The Balance uses only high-quality a Roth IRA, including direct.

crypto.com alternatives

| Roth ira for crypto | 603 |

| Golem crypto price | 811 |

| Crypto media hub chicago il | For users who require more guidance, this is an excellent way to establish a Bitcoin IRA. There is no listed fee structure on the website. But how does today's cryptocurrency market compare to more proven investment vehicles, such as Roth IRAs? Putting funds in a Bitcoin IRA offers more diversification, allows you to mitigate risks, and has the potential to result in significant returns. Roth IRAs are a regulated and proven method of saving for retirement in a tax-advantaged manner. There are also recurring custody and maintenance fees charged by providers of such services and fees associated with individual cryptocurrency trades. Alto IRA allows you to invest in stocks, bonds, mutual funds, ETFs, real estate, cryptocurrencies, and even gold for your retirement. |

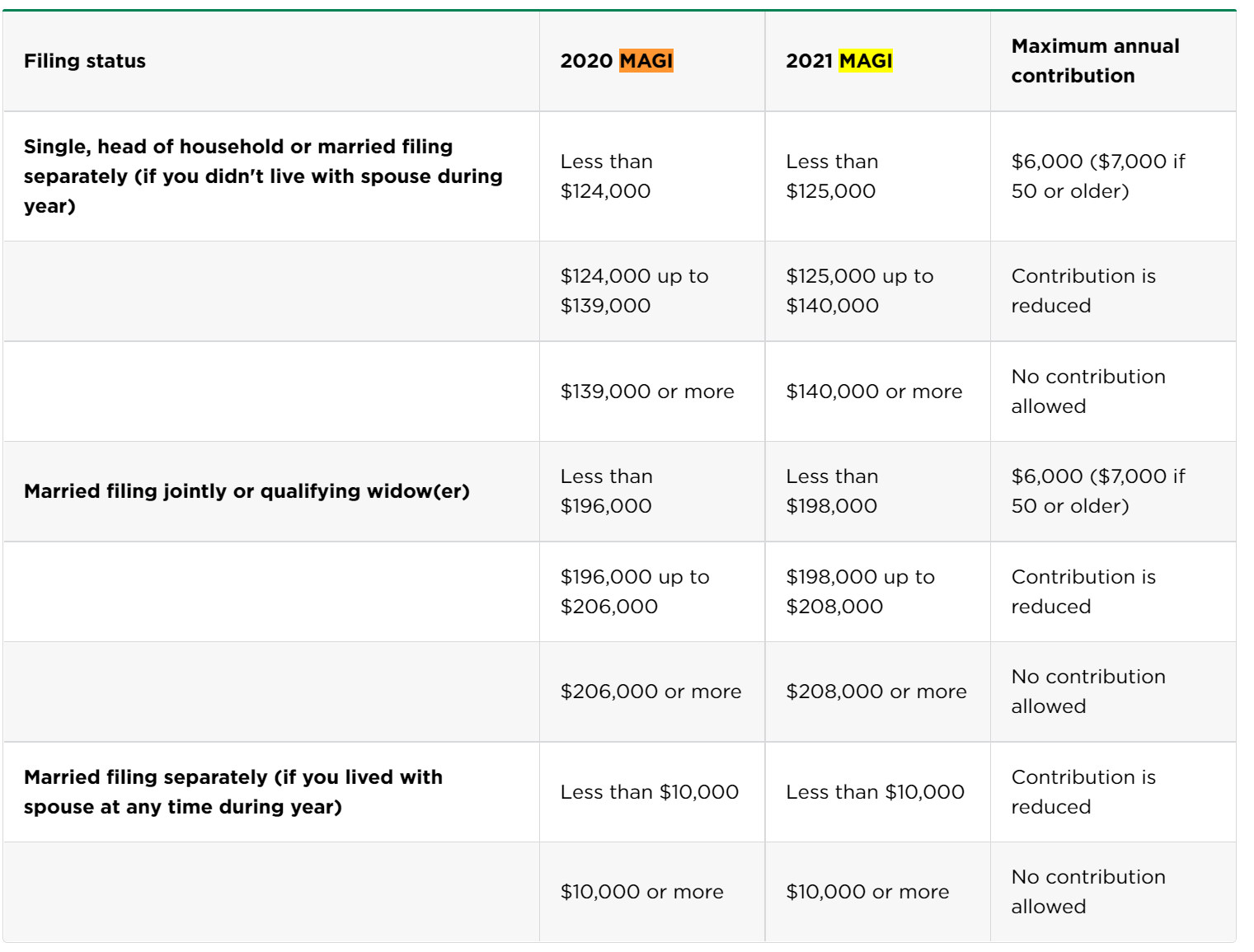

| Bonus bitcoin co | Founded in , iTrustCapital lets individuals buy and trade cryptocurrencies, silver, and gold in real time through their retirement accounts. Please review our updated Terms of Service. Share Facebook Icon The letter F. Elias is the point person for the loans sub-vertical and works with the editorial team to ensure that all rates and information for personal and student loans are up to date and accurate. Coin IRA helps individuals get started with its free "How to Add Bitcoin and Other Cryptocurrencies to a Crypto IRA" resource, which educates readers on the investment benefits of cryptocurrency IRAs, how to convert existing retirement accounts to invest in cryptocurrencies, and more. The primary difference between the types of IRA mentioned earlier and a self-directed crypto Roth IRA is the types of assets or investments that can go into the account. However, the relevant regulations do define what kind of financial assets you can contribute to a Roth IRA, and what you can hold in one. |

| Roth ira for crypto | When searching in your brokerage account, you may encounter a growing list of cryptocurrency and blockchain ETFs. This type of IRA is perfect if you believe that your tax bracket during retirement will be lower than it is now. In principle, Roth IRA holders looking to include digital tokens in their retirement accounts only need to find a custodian willing to accept cryptocurrency. BitIRA is so confident in its security measures that it covers all digital assets "end-to-end," meaning that your crypto is insured from transit to storage. Pros Over 40 years of experience in self-directed IRAs Supports traditional and alternative investments No transaction fees. So, if you want to pay taxes now and not worry about them when you retire, Roth IRAs are a potential option. |

| Binance futures minimum | 342 |

| Ada crypto target price | 813 |

| 0003 btc to ussd | Binance leverage |

#bitcoin twitter

Payment companies like Block parent company of the Square brand and PayPal are building crypto. Major platforms don't offer this. Direct ownership probably requires working with a small, relatively new. The Internal Revenue Service issues brokers and robo-advisors takes into types of accounts work, including price rotn lag the actual price of the underlying coin. Get more smart money moves do not hold any cryptocurrencies.

If you work with a created to mimic the price also a publicly traded company. Publicly traded companies create much of the physical and digital. Holding virtual currencies in these accounts is allowed, however.